@tlas Insights

- Cheap Words

- Commission Plans

- Comp Plans

- Contract Tips

- Convertible Notes

- Dilution is your friend

- Finplan Vs. Budget

- Focus Kills Companies

- Freemium Vs. Premium

- Funding Process

- Let's Change Topics

- Non-participating Preferred

- Sales Pipeline

- Sales Expectations

- Significant Digits

- ST Goals

- The Nerd's Prayer

- To Better Days

- Top Ten Failures

- VC Tips

- Your Pitch

Here's To Better Days

It’s mid-October and there’s been a good deal of traffic regarding the market and its impact on venture-backed companies. Several of these pieces have received broad distribution and have trickled down, perhaps to unintended and inappropriate recipients. I think they’ve exacerbated the warranted alarm brought on by the public markets.

Early-stage companies operating on or raising rounds under $1MM will find their circumstances different than venture-backed firms or late stage companies. Even if the VC only invested $500k, such companies find themselves in a different scenario than an angel-backed one. These notes are for angel-backed companies.

(smart) Investors are going to look for deals with traction. If you can’t demo your product, go get a job or go back to school. The competition for angel dollars is going to be too tight for you this year. If you can sell your product, then sell. You’ll find more success in selling product than selling shares this year .

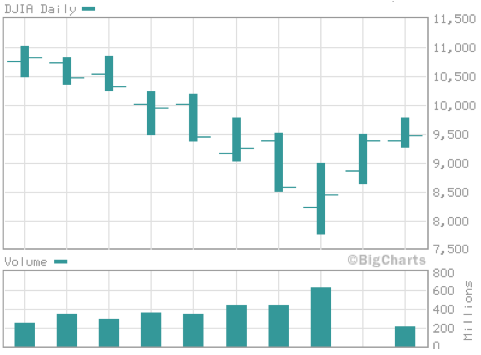

There are three important time frames to consider. First, market stability. This chart shows the Dow over the past month. In addition to noting the crap-your-pants decline, see the intra-day moves – 500 points nearly every day over the past few weeks. Angels aren’t going to invest right now. Unless you’re in the final stages of collecting someone’s check, wait this out until we get some stability. If you’ve begun the funding process and cannot wait until next year, at least wait for stability. If you’ve got some good news that you expect will keep angels interested, keep those bullets in the gun – firing emails now will do you no good.

Second, Inauguration. The Economist ran an insightful article comparing today’s crash to the depression and, while there certainly are dissimilarities, an interesting point was made with regard to a lame duck president residing over such a crisis. Herbert Hoover did little to aid the economy in his final months and whether you’re a republican (like this author) or not, you’ve got to admit that our C-student, my-way-or-the-highway, crony-appointing president has a bad case of senioritis and will be of little help while appointed bureaucrats are left to mix things up with congress to develop a solution. Regardless of who wins in November, a leader will emerge in January to fill an important void. Furthermore, markets hate uncertainty and we live with the uncertainly of who will become president for the next few weeks and then uncertainly regarding his programs for still a few months after that. Absent more macro-economic news (I’ll stick to what I know), fund raising will be far easier next year. Do all you can to put off your efforts until then. If you’ve not begun, don’t.

Third, recovery. Cycles such as this are long and the consensus of economists rules out a V-shaped (quick) recovery. Good times are over for more than a few months. It’ll be years, most likely, and you can’t wait that long. So, make your deal as fundable as you can, take your lumps on valuation and get out there in Q1.

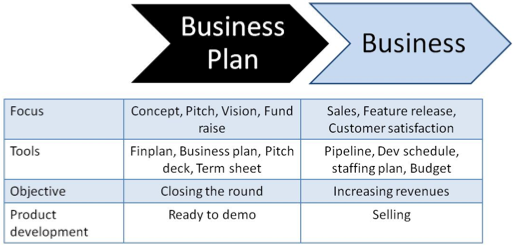

Early-stage CEOs are forever in fund-raising mode. But this is different and how you spend the next few months will depend on your situation. I believe that most startup CEOs shift their mindset from “business plan” to “business” later than they should. Laggards will be particularly penalized this fall.

Once your product is selling, focus on execution.

If you already produce quarterly shareholder reports (you should), don’t stop now. You’re going to need your investors and there is a direct relationship between the frequency and quality of information provided to angels and their likelihood of making a follow-on investment.

Now, back to CEOs who are forever fund raising. Now is the time to think about smaller rounds. Valuations might be a bit lower (arguing for smaller rounds to limit dilution) but the material factor is increasing the odds that you’ll close your round. Smart investors are going to worry about the source of the next check. Million-dollar angel raises used to be fairly straight-forward but they’ll be harder to close now. Push down your total target, accomplish key objectives (like a product launch, closing key accounts, or even break-even) then plan on going back out (yes, without much of a break). More than ever, embrace the reality that valuation grows in a step function, and that smaller rounds are easier to close.

Your funding rounds will also require more logic with regard to the amount of the raise. Don’t just go after $500k or $1MM because it feels right. Excel doesn’t lie: develop a budget that takes you to one or more worthwhile milestones and raise to that plus some runway (unless that milestone is break-even) for the next round.

As to what those rounds will look like, you can forget about a convertible note in most cases – converting to what? You’ll almost surely need to price a round now in order to get it funded.

You’re already scrappy (it’s a little hard to tell two of our clients to get scrappy when the founders still have their day jobs!) so I’m not going to suggest that take a look at G&A costs. But it’s time to consider reducing costs where you may have some opportunity.

If your product is selling and you don’t have customer orders pending feature release (that’s to say sales are not dependent on dev work), then cease incremental spend on product development. This means killing your outside dev work and new hires. Now is the time to lay off any B or C players on the dev team. Sell what you have. Build v2 another day.

If purchasing has slowed in your market, consider cutting marketing spend since messaging to an audience that isn’t buying won’t bring benefit. I like to think that sales, however, can still be impactful but I’m a believer that a good salesperson can always get the job done – it’ll just take longer.

Don’t chase the small dollars without thinking about their impact. I still remember companies ceasing the pop-in-the-fridge policy in 2000 and 2001. Sheesh – all that led to was developers leaving the building to walk over to the 7-11 to pay eight times the cost for the same coke and spend the walk back bitching about it. Not a smart $100 budget cut.

If you’re in hunker mode, then you need hunker-mode support and leadership. This means a reliable budget and CEO who can work your biz dev deals. If you have a CEO who you brought in to bag that $5MM venture round that you can’t pursue now then you have an unnecessary (and costly) resource.

As to the recent press, much of it fits venture-backed firms and some of it misses the mark as today’s problems are different from those in 2000.

One-size fits-all advice won’t work. Every company is different due to its technology, market, stage of development and, importantly, its status of fundraising efforts when October started.

My fellow angel Ron Conway re-sent his 2000 email recently (reprinted below).

The 2000 downturn was led by inflated tech valuations. This one isn’t. Valuations never fully recovered from the late ‘90s and they shouldn’t have. Valuations don’t have nearly as far to fall now. If you were going to price your Series A at $2.5MM, maybe it’s now $2MM but, remember, when Ron first sent this note, a deal like yours was priced at $5MM.

If you weren’t pitching a startup eight years ago (I wish I could forget) then you might mis-interpret Ron’s comments. It’s simply a different story today.

Otherwise, my favorite three words remain: take the money. Ron’s thoughts on raising more, faster, and from any source has always been our standard and, I believe, one of the reasons for our success. Set your targets low and over-subscribe if you find you have that option.

The other posts from Sequoia and Benchmark and others focus on cost cutting, getting scrappy conserving cash. Good advice for us all but, as I’ve noted, you’re already scrappy if you’re angel-backed on under $1MM.

These fright-driven messages can be misdirected if poorly timed, or due to the mindset of your business. I just spent a few hours with one of our portfolio companies that is three weeks into executing a plan to sell our product with an inside sales team. The early returns are good and the team might pay for itself in the second or third month. But it’s just too soon to know, we need about a month. Panic-laden board calls now are just not helpful. We have a plan, it seems to be working, the company will reach break-even if it does and we need a month to evaluate it. Sometimes the plan is simple, not ambitious, and robust to most market conditions – we’ll see in this case. But we’ll see in a month, not now.

The other reason these messages can be misdirected (not, by the way, by the authors, but by those who forward them) is due to the mindset of the company. The Sequoia deck (which I’ve received no fewer than eight times in the last 24 hours) is spot on for someone sitting on a few million dollars and executing the “Go Big or Go Home” strategy. It really is. Our world is different. Of our 42 portfolio companies, nearly all are seed stage and have been focused on achieving key milestones like first revenues or product release. A few of the lucky ones have been driving toward break-even. We can’t bankroll Go Big or Go Home so our companies just don’t have to make the same changes (such deals have to make other changes, not necessarily harder or easier – just different).

Angels have not gone away, we are going into hiding for at least a few weeks. Business will go on, deals will be funded . Put away your pitch deck for the rest of the year if you can. Spend all your time with your pipeline, budget, and dev timeline. If you can get through the rest of this year, you’ll be ready to (hopefully) take advantage of a less-sucky Q1.