@tlas Insights

- Cheap Words

- Commission Plans

- Comp Plans

- Contract Tips

- Convertible Notes

- Dilution is your friend

- Finplan Vs. Budget

- Focus Kills Companies

- Freemium Vs. Premium

- Funding Process

- Let's Change Topics

- Sales Pipeline

- Sales Expectations

- Significant Digits

- ST Goals

- The Nerd's Prayer

- To Better Days

- Top Ten Failures

- VC Tips

- Your Pitch

The Power Point Comes Last

There are probably more ways for a startup to get funded than there are slot machines in Vegas. The most interesting make the best press and, so those are the deals we hear about: two guys getting $10MM after they give a demo to Sequoia; the (somewhat) elusive strategic investment coming in along with a distribution deal; the $22MM series B that was bid up by competing term sheets; the round that’s scooped up by a few $500k mega-angels. Except for the first one (I’m not holding my breath), we’ve seen these and others but that’s based on a sample size of about 200 quality deals in over a decade.

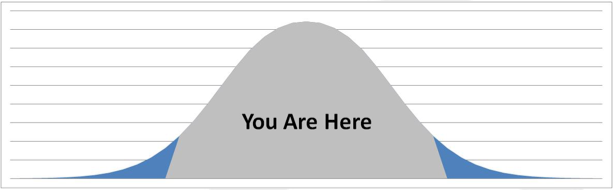

Hoping for or planning on this sort of outcome is not just optimistic, it’s irresponsible. There’s a normal distribution to most things in life and the road to startup funding is no different. And, I hate to tell you, but you’re not special. Well, actually, you might be – your deal might actually close the round you’re seeking. But it’ll be an annoyingly long slog with a first round probably of about $500k - $2MM made of too-many $25k checks a few low-six-figure ones. It’ll take you 3-6 months if you do it right and you’ll have time to enjoy that Snickers bar of questionable age you discovered in the break room before you have to go out for your Series B.

Ok, hopefully we’re all over that now and you’re comfortable with the notion that you’re like everybody else. Now, let’s talk about the steps in getting your company funded. You’ve already got your concept (your product or service) and your team and you’re able to give the general story of your business and vision. There are four specific documents you’ll need to create:

1. Financial Plan

2. Business Plan

3. Term Sheet

4. Pitch Deck

(the order matters)

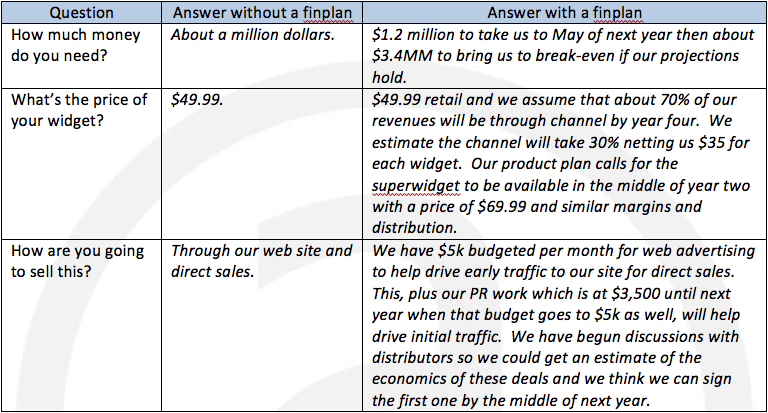

The Financial Plan (we call it the “finplan” and, yes, we do feel cool when we do so) is the basis for your business. The downside of preparing this first is that it’s the hardest one and takes some technical skills. However, a solid finplan (oooh, I like that term) requires answers to these questions:

Who is our market and how big is it?

What are our products/services and what are our prices?

How will we sell – inside sales, direct, bizdev, channel?

How many people of what skill sets will we need?

How fast will we grow?

How much investment money is required?

If you skip ahead, you might find that you can tell a general story about the business and even produce some top-down financials. But a good finplan has more detail and stands up to scrutiny – it’s the foundation of an execution plan.

With the finplan in hand, we’re ready to write the business plan. We have many questions answered but now need to add some details on our go-to-market strategy like who are our likely initial customers and where exactly will we find them? Also, we’ll develop a competitive matrix and a product development timeline, possibly a stage table to help the reader grasp the overall company history and future. All the charts, tables, and images we’ll need should appear in the plan.

And what are we selling to investors? Well, that’s what the Term Sheet answers. If we want to get input on what’s market for our deal, we can provide the business plan to some active angels[1].

So, why is the pitch deck last? Because it requires a sub-set of the others. Creating the other docs first requires you to dig deep and that foundation will allow you to survive diligence questions. That planning also helps with execution should you become one of the funded. Your deck will be easy with the hard work behind you and you’ll be more confident as you present it.

Now, go get ‘em!

[1] Please don’t ask your accountant, attorney, highly successful friend or banker unless they are writing at least 2-3 checks a year to companies that are similar to yours.