@tlas Insights

- Cheap Words

- Commission Plans

- Comp Plans

- Contract Tips

- Convertible Notes

- Dilution is your friend

- Finplan Vs. Budget

- Focus Kills Companies

- Freemium Vs. Premium

- Funding Process

- Let's Change Topics

- Sales Pipeline

- Sales Expectations

- Significant Digits

- ST Goals

- The Nerd's Prayer

- To Better Days

- Top Ten Failures

- VC Tips

- Your Pitch

Sales Expectations

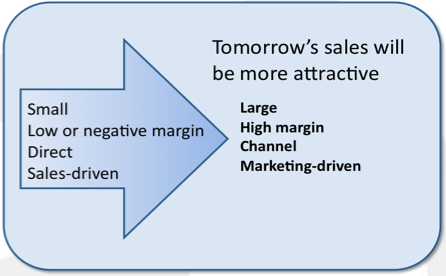

When we read business plans, we find that most entrepreneurs tell us how they’re going to scale to their mature size. The plans focus on the channel sales, the viral growth or some other aspect of sales that is highly scalable and compelling.

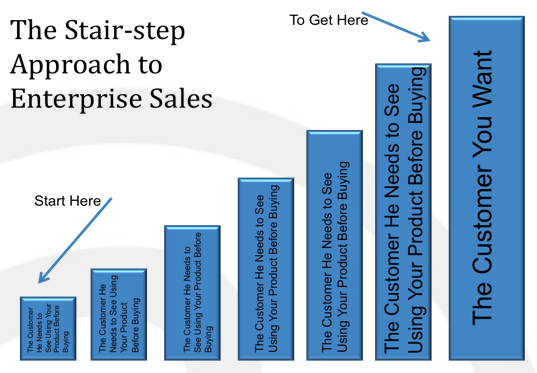

But why do some startups get initial traction while others don’t seem to get off the ground? Because some CEOs embrace one vital reality: the way you sell today won’t be the way you sell tomorrow.

Your business plan is great and your sales strategy is exciting. But if you don’t start selling now with different (typically lower) expectations and (typically less interesting) methods, you won’t get the initial traction you need. Your plan may talk about how you grow from $1MM to $100MM in revenue but that’s not necessarily how you’ll grow from zero to $1MM (of course these numbers vary). Let’s talk about what’s different and why.

- Size of the deal. Your initial sales will be smaller than the sales you hope to have eventually. There are several reasons and this could be our most important point:

- Sales cycles are proportional to deal size and you need to close business now. Closing business sooner will make fund-raising easier, will bring in cash, and will get users sooner. Getting users sooner means that you’ll more quickly learn what you did wrong in building the product and what needs to get fixed in your customer support.

- Your product or service quality will get better over time so don’t sell to a company-maker (i.e. the "big customer") now. You’re going to have problems with both the product and how it’s supported. Let a less-important customer experience these issues and work with you to improve them.

- Your deal terms will be flawed. Even with all the smarts that the best contracts attorney can offer, you’re still going to miss something. Maybe you’ll get deal terms wrong by insisting on something you later learn doesn’t matter at all. Maybe you’ll omit an important protection. You won’t get it right the first time. Make mistakes on smaller deals and perfect your deal terms by the time it really matters.

- Your pricing will be wrong, possibly both in structure (e.g. subscription vs one-time sale or pricing mix of core product vs the disposable portion) and price. Make these mistakes on lower-revenue deals as you learn how to optimize revenues and margins.

- You simply won’t be successful because larger buyers will more likely demand reference accounts to demonstrate the product or service works as advertised.

- Margins. Margins will improve over time. Ok, this is obvious but most entrepreneurs don’t act accordingly. Too many entrepreneurs pass up early opportunities because they’re unattractive. But they often fail to factor in the value of closing the business – a reference account, a customer who will help you improve the offering, and increased investor interest (yes, investors are smart enough to understand the concept of margin improvement). If your first potential deal is a relatively small opportunity, worry more about getting it done and less about the margins on it. This is, of course different for a company that’s selling to a finite number of potential customers (e.g. a product sold to US auto manufacturers or cell phone manufacturers) or if you’re working a real opportunity to sell to a large player early in your company’s life.

- Channels. Your business plan might call for others to sell your product but don’t count on that initially. While the effort of channel partners varies greatly from just "order takers” (think retail) to proactive sales groups that will energetically sell because they make their money on installation and support (think software system integrators), very few channel partners will close business for a product that has not had a customer before. Note that I don’t say few channel partners will sign on to sell your product – they’ll do that. But signing and actually selling is the difference between your college buddy who says he’s there for you and the when he actually shows up on the day you’re moving with his truck. We wasted a fair amount of time with Meteor, trying to get ad agencies (they barely get a passing grade as channel partners) to resell the product until we realized that we had to close business first. Once we showed good traction, they engaged.

- Marketing-driven sales. Most consumer web deals and many other products focus on marketing-driven sales. Your plan shows that viral growth or marketing spend will drive traffic with good scale effects. Nearly all successful companies in your space probably grew this way. But few obtained their initial users this way. A great example for us was Findood. This market maker (grocery store buyers connecting to food manufacturers) had a plan that was based on marketing to bring both parties to the web site. But the marketing budget needed to get this started was impractical for the startup. So we picked up the phone. We called on both sides of the market to seed the site with a critical mass of buyers and sellers. To make the marketspace more attractive, we focused our efforts on a sub-market (chocolate in this case) to yield better concentration for our efforts.

Of course there are stories of companies which had great success at very early stages and you should explore these bigger, better deals on a parallel path. But understand they probably won’t close soon; don’t bet the business on having an extraordinary success early-on. Focus on Plan B with smaller deals on less attractive terms. You’ll get customers, you’ll get investors, you’ll perfect your product or service, and you’ll avoid the fatigue of a startup that just can’t quite seem to get it going.